This post is sponsored by Lexington Law but the content and opinions expressed here are my own.

No one ever told me the importance of having good credit when I was young, so I never worried about my credit score. In fact, I didn’t know a single thing about credit, and when I finally started to learn about it, it was too late. Fast forward many years, and I started trying to build my credit. It was a slow process, and finally I was able to get a loan for a truck, with an insanely high interest rate.

Now I’m working towards getting a home loan, and my husband is dying to get a second, more reliable car. We would also like to get newer snowmobiles before next winter, and have plans to buy a camper. Now that the kids are grown, I’d like to do some more traveling and see beautiful new places more often. I’m at the point where I’m staying on top of my credit score, but I could use some guidance on how to get things to where they need to be.

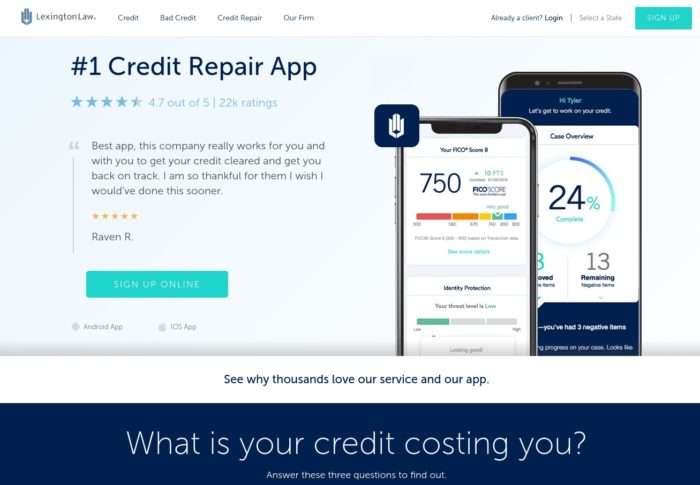

That’s where Lexington Law comes in, because through them, I can get a free credit report consultation, and I am able to monitor my credit. They will work with you on credit coaching and monitoring. Lexington Law can also work with you to repair your credit and challenge any incorrect items from your credit report.

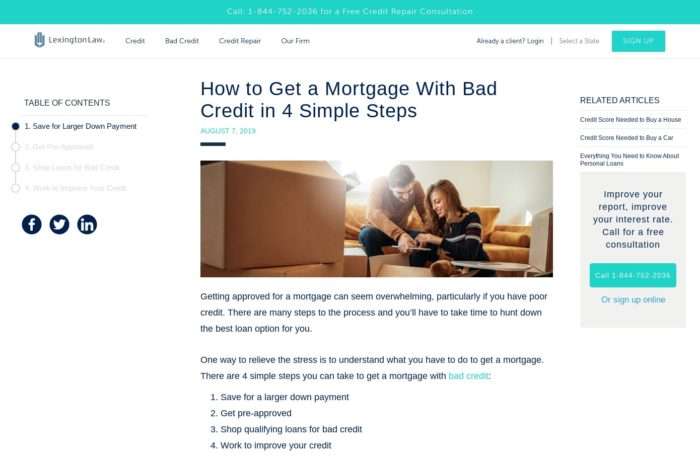

Their website is easy to navigate, and is full of useful information for people like you and I. They have articles on credit score and credit report topics, and topics on things that can damage your credit, like medical bills and divorce. They also discuss topics like bad credit loans for automobiles and home mortgages.

With over 10 years of experience, this consumer advocacy law firm has helped Americans take the steps that they need to in order to work towards better credit. Sign up to stay on top of your credit with help from the professionals at Lexington Law.